What Credit Score Is Needed For Harley Davidson Financing

If you seek financing through a motorcycle dealer it might send your application to several lenders each of which might use a different credit scoring model.

What credit score is needed for harley davidson financing. The credit score design was developed by the Fair Isaac Corporation typically known as FICO and it is used by financial institutions like banks. Not all applicants will qualify. If its a used Harley that caught your eye our no-hassle financing applies to those too.

We can get you the financing you need to buy one of late model certified used Harley Davidson motorcycles even if you have bad credit. Even with the tightening of credit over the past 24 months a score of 740 or higher should qualify you for the best rates and terms available. In fact the lender might even look at several credit scores.

But youll have more options if you have a credit score above 670 what most lenders consider to be a good credit score. Scores between 580 and 669 are considered fair and anything below 579 is considered poor. This is up from 700 and then 720 over the past 6.

399 APR offer is available only to high credit tier customers who have completed a Riding Academy Skilled Riders MSF or other state accredited course within 180 days of application date and only for up to a 60 month term. It stands to reason that the better a product is made the longer it will last which makes getting a high-quality low mileage Harley-Davidson motorcycle at a great price a very savvy move. Harley Davidson doesnt publish credit score requirements.

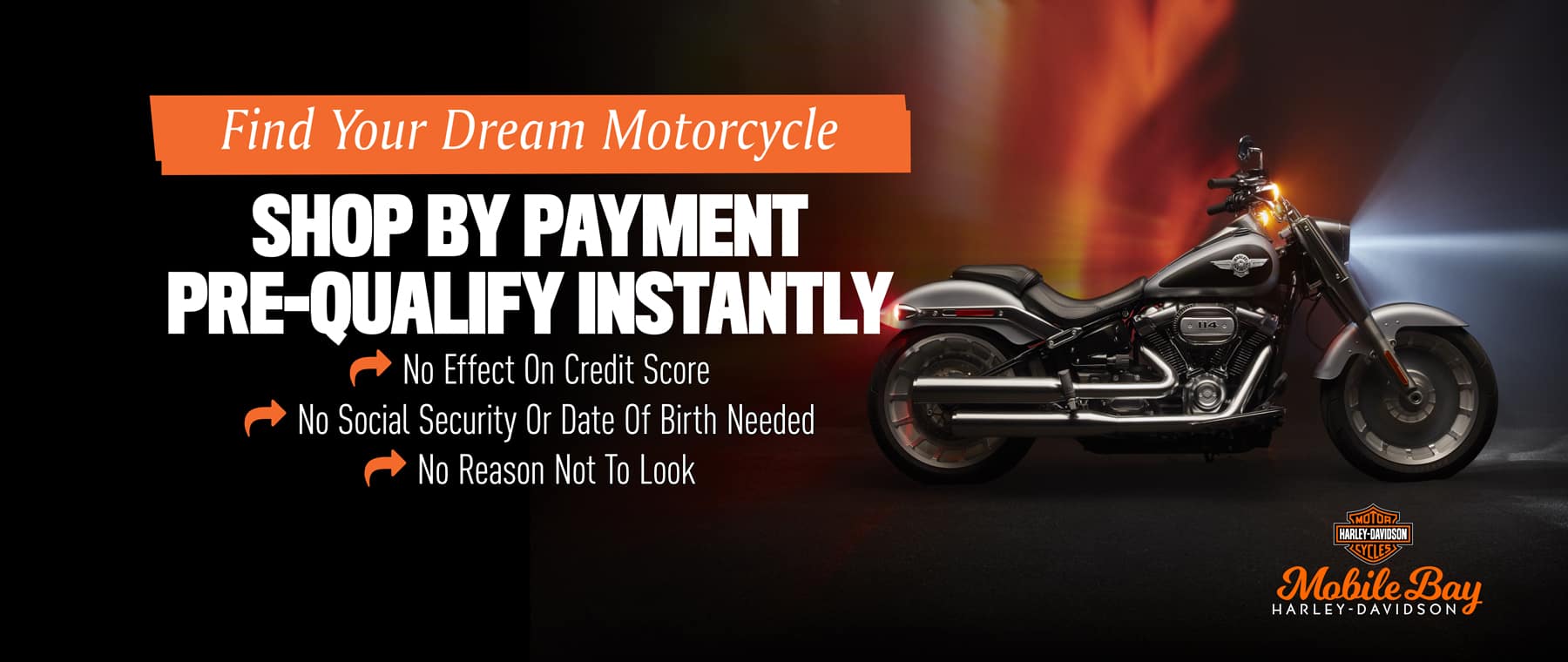

Youre A Good Fit For SNAP. 04 to finance 6K of an 18K bike and they quoted me 85. Even For People With Bad Credit.

A recent FICO report showed over 68 million Americans currently have bad credit. If youre looking to buy a new Harley-Davidson with bad credit we have a wide selection of 2019 Street Sportster Softail Touring Trike and CVO models. Have short time on a job or even self-employed and have a hard time proving income.