Harley Davidson Financial Analysis

The primary business activity of the company is Motorcycles Bicycles and Parts SIC code 3751.

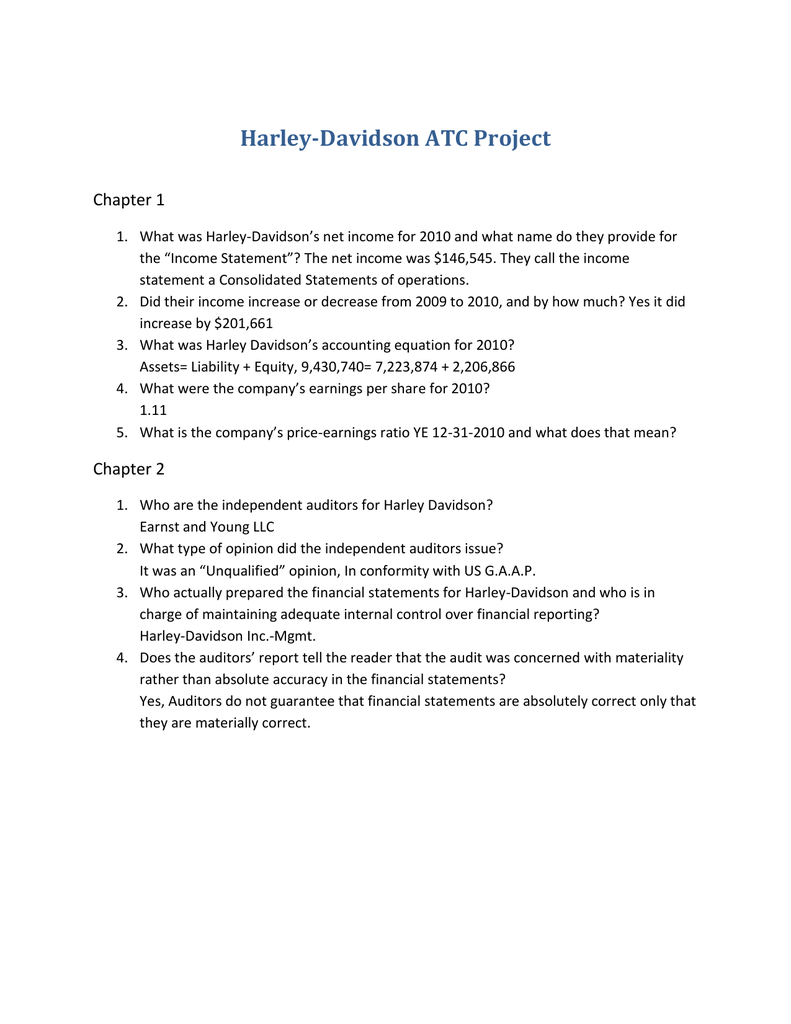

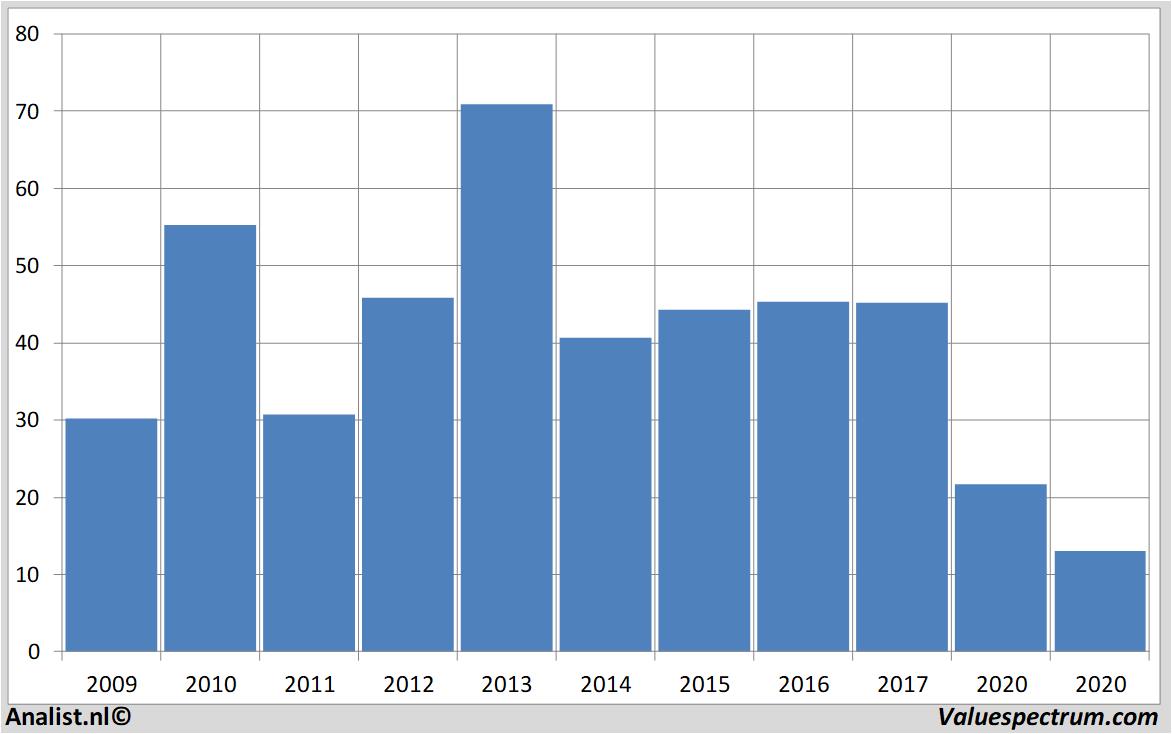

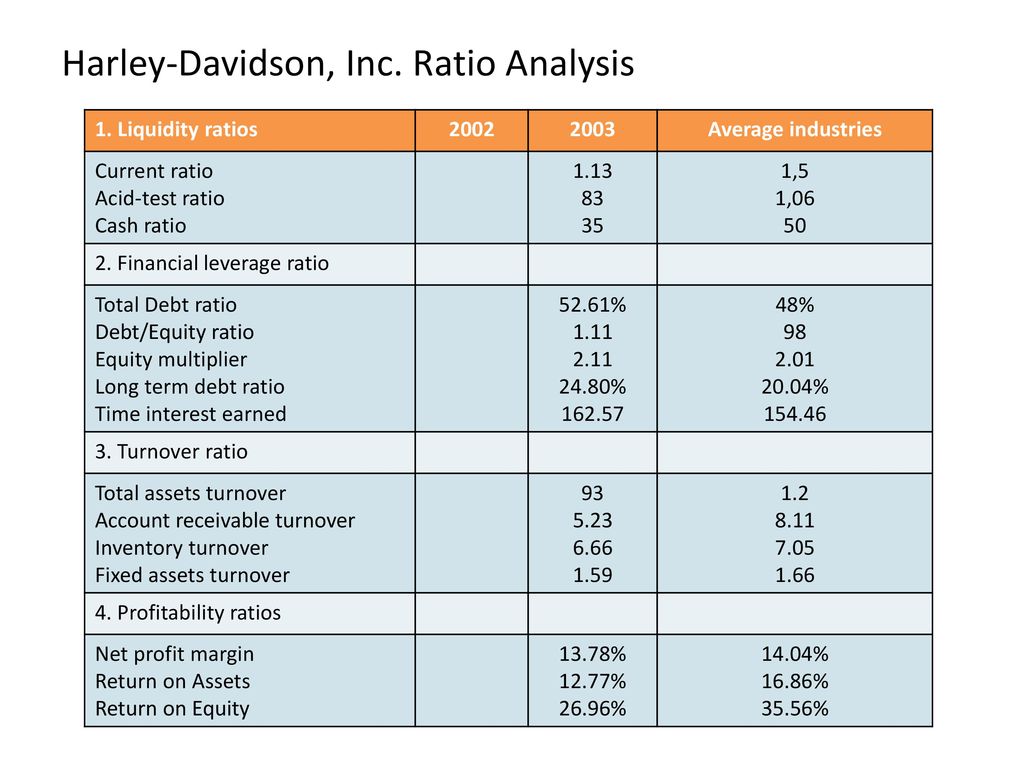

Harley davidson financial analysis. First we have found that Harley is a highly liquid company. The EVEBITDA NTM ratio of Harley-Davidson Inc. We have conducted a comparative analysis of the balance sheet and the income statement of Harley-Davidson Inc.

Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc. Harley Davidson Strategic Analysis 1. Saneya el GalalyPresented By.

HARLEY-DAVIDSON INCs gross profit margin for the second quarter of its fiscal year 2021 is essentially unchanged when compared to the same period a year ago. After reviewing the financial reports of Harley-Davidson we have come to several conclusions about the health of the company. It is currently a public company with over 100years of experienceproducing motorcycles.

This table contains critical financial ratios such as Price-to-Earnings PE Ratio Earnings-Per-Share EPS Return-On-Investment ROI and others based on Harley-Davidson Incs. Securities and Exchange Commission SEC. This will be 100 for a firm with no debt or financial leverage.

The net profit of the company was USD 59911 million during the fiscal year 2011 an increase of 30883 over 2010. According to these financial ratios Harley-Davidson Incs valuation is way above the market valuation of its sector. 2018 Harley Davidson financial analysis.

There are five lines of motorcycles manufactured by Harley Davidson which has its. Discounted Cash Flow Model. The need to expand globally is fueled by the companys financial situation.